The year 2021 has had a significant impact on digital consumption patterns. The pandemic provided a powerful incentive to create a globalized payment network which quickly and directly affected the world of finance including alternative payment methods. Online shopping has exploded, and mobile has become our preferred payment option. In addition, thanks to rapid and massive changes in the economy, social conditions, regulatory landscape and in everything related to technology, the Carrier Billing ecosystem continues to experience an absolute revolution. Numbers speak for themselves – The global Direct Carrier Billing market was valued at $ 29.8 billion in 2019 and is projected to reach $ 70 billion by 2025.

What are the main trends around this opportunity-filled payment method? Discover all the trends that will help you to prepare for the future evolution of Mobile Payment.

1. Global Consolidation of Alternative Payment Methods (APMs)

As we previewed last year, the pandemic has accelerated the use of mobile payments and the overall consolidation of a cashless society. Covid-19 has also amplified the shift to Carrier Billing across many markets worldwide as consumers seek to avoid exchanging cash and touching payment terminals. This situation, has turned DCB from a solution in underbanked areas into a truly global opportunity.

According to data revealed by a Futurist Group study, around 38% of consumers perceive contactless as a basic feature of payment. Moreover, online purchases are increasingly being performed on a mobile device. 451 Research estimates that online purchases conducted on mobile devices accounted for 51% (USD 2.4 billion) of the total in 2020, a share which will grow to 53% (USD 2.8 trillion) this year and 64% (USD 5.2 trillion) by 2025.

We can say that we are in front of a mobile driven society where users demand immediacy and convenience when making their payments.

For this new mobile economy, Direct Carrier Billing is a payment method with huge potential. It allows users to pay for digital services as part of their monthly bill, offering them an enriched purchasing experience. DCB enables a fast, easy and secure online payment flow and spares users from sharing their personal data or bank details online. For these reasons, it provides a great opportunity for Telcos to increase their revenues and for Merchants to achieve higher conversion rates.

When talking about payments, a frictionless experience refers to the reduction of steps involved in the checkout process. New consumer habits show how users progressively demand a streamlined shopping journey in which they need to spend as little time as possible to make a purchase.

Alternative Mobile Payment methods (One-Click Payments, Wallets, Contactless…) offer exactly this kind of experience. Carrier Billing is particularly the preferred one since it can register and charge the user through just 1 single click. It reduces the payment process x5 compared to credit cards.

Subscribe to our newsletter to keep up to date with the evolution of this ever-changing ecosystem.

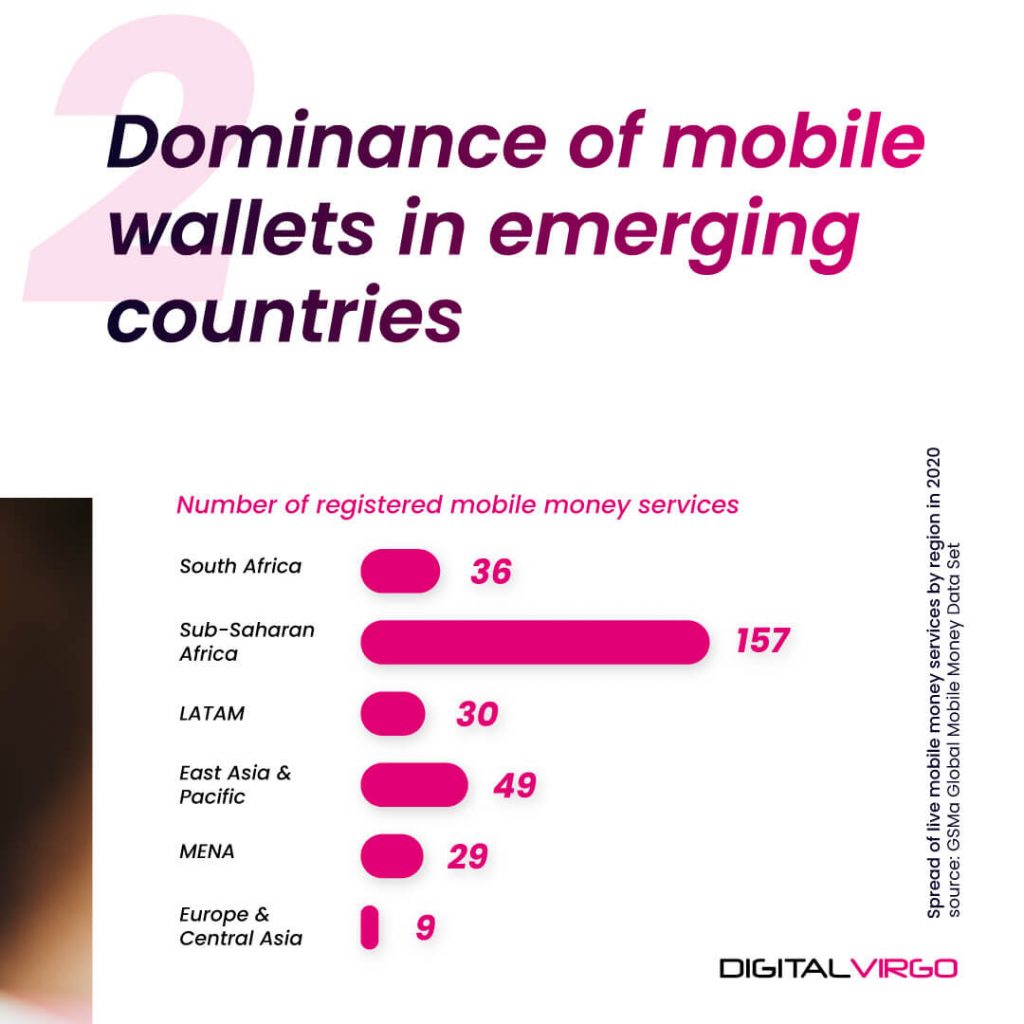

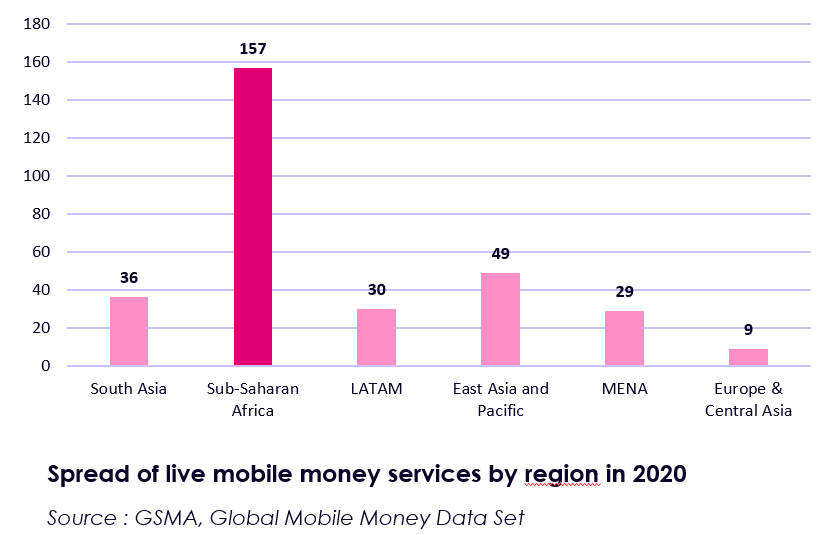

2. Dominance of Mobile Wallets in Emerging Countries

Covid-19 accelerated customer adoption of digital wallets, mobile payments and alternative convenient payments became the norm. Digital wallets are expected to become the most popular in-store payment method. The number of mobile wallets in use is on track to reach 4.8 billion by 2025 (up from 2.8 billion in 2020) – nearly 60% of the world’s population. Besides, Yahoo finance reveals that digital wallets will account for more than half of all e-commerce payments worldwide by 2024.

Emerging countries are the birthplace of mobile wallets. In 2020, among over 310 registered mobile wallets, more than a half were in Africa.

In the fastest-growing mobile wallets markets – Southeast Asia, Latin America, Africa and Middle East – mobile wallets are rapidly replacing cash and cards.

In those countries, financial inclusion rate is very low compared to other regions of the world. Digital wallets fit totally with emerging market realities as it allows users to be easily and securely financially included.

More than that, mobile wallets also allow users to access to digital services. The increased possibility of accessing digitals services represents an important opportunity for telcos and merchants. For example, some of African countries concentrates markets that are not saturated. In 2020, African mobile money market counted more than 560 million registered accounts which represented in transaction value 495 US Dollars – GSMA State of the Industry Report on Mobile Money 2021.

This is a spoil … New Alternative Payment Method is coming soon. Stay Tuned.

3. Boost of Carrier Billing for New Verticals in Europe

Regulation plays a key role in any business, including mobile payments. It is a strategic issue that needs to be addressed at the local level and determines the deployment and success of the business. In the case of Europe, an important driver of the Carrier Billing market is the recent Payment Services Directive (PSD2). This opens the door to a strong growth of the DCB ecosystem, allowing the use of Carrier Billing for new verticals such as physical goods, in addition to digital goods. Now, this payment method can be applied to e-vehicle charging, fast-moving consumer goods, food and product delivery, e-rental, vending machines, ticketing and many other activities with an e-money institution license. In addition, transactions above the thresholds of EUR 50 and EUR 300 are also allowed with this license.

This is a market full of potential considering data recently revealed by Juniper Research, which shows that online sales transactions of physical goods will increase from $3.3 trillion in 2020 to $4.4 trillion in 2025, a 33% growth accelerated by the COVID-19 pandemic.

Besides, digital sectors such as m-Ticketing are booming in Europe and the data speaks for itself, ensuring that it is a trend that is here to stay. According to Juniper Research, digital ticket transaction volumes will exceed pre-Covid levels by 2022; rising from 12.7 billion in 2020 to 32 billion in 2022.

As an international player in the field of mobile payments and an e-money institution license holder, Digital Virgo Group is able to offer payment and e-money services across Europe. These authorizations are essential to support telecom operators and merchants in their core business activities.

Contact our experts, tell us who you are and we will inform you on all you need to know about regulation for Alternative Payment Methods.

4. Telcos as the Convergence Point for Digital Entertainment

Mobile operators are directly linked to billions of people. With more SIM cards than people in the world, Carrier Billing becomes an attractive payment method worldwide.

Telecom operators are looking to take full advantage of this payment method and position themselves as the central point of digital convergence. Digital merchants want to increase their customer base and expand their business by responding to new consumer demands.

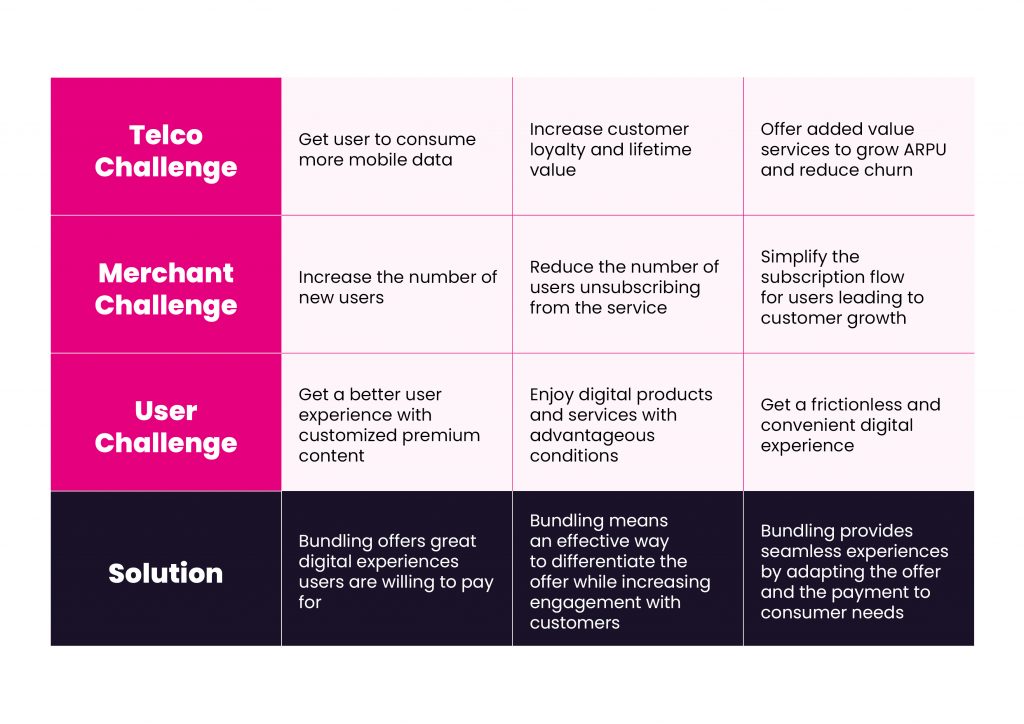

One of the most efficient ways to achieve both players’ objectives is bundling, which leverages an operator’s brand, distribution and billing assets, and OTT merchants gain fast and efficient access to a large customer base.

In this environment, mobile operators are beginning to realize the value of bundling, which, if done well, can drive greater new customer acquisition and increase the lifetime value of their existing base through higher average revenue per customer (ARPU) and reduced churn.

In terms of the verticals that dominate such partnerships, video on demand (SVOD) is leading the way. Also cloud gaming and other streaming content providers are gaining ground. In addition, new areas such as artificial and virtual reality are starting to incorporate such strategies.

Considering that around 800 million bundles have been made in 2021 according to a report shared by Ovum, we can sense that this trend will continue to dominate in 2022 and beyond.

Exciting news will arrive soon. In the meantime, find out how we’re helping telcos take mobile payment to the next level.

5. Customer Satisfaction at the Heart of Mobile Payment Success

This year we introduced you a white paper on how to maximize Customer Satisfaction in the Carrier Billing ecosystem. It has undoubtedly become a priority for the entire industry and is at the heart of the challenges faced by the main players in the alternative payment method sector, especially mobile payments. Regulation, security, transparency, customer service, all have a common goal of improving customer satisfaction.

By sharing their satisfaction, a single customer can bring in an average of 5 to 6 new customers. Therefore, a satisfied customer plays an important role in building the company’s reputation. Securing a satisfied customer ensures the sustainability of the business, while a dissatisfied customer means lost business and, more importantly, reputational damage that is difficult to reverse.

A clear trend in the business which should be a priority for the whole industry – is to address mobile payment in its entirety, not only transactionally but also in terms of the customer journey.

In DCB, users are looking for:

–Clear information in the purchasing process

-Secure environment when making payments

-The quality of customer care

-A product that is fully aligned with their expectations

At Digital Virgo, we deploy global strategies that take into account strategic aspects such as transparency and security, local adaptation, customer care, quality of service and regulatory framework. This is part of our DNA. Beyond a payment solution, we propose business growth strategies. Find out more about Customer Satisfaction in our recent white paper.

Stay connected because this year we will talk a lot about “Making our client’s clients Happy!!!”

6. Rise of Internationalization and Cross-Border eCommerce

Thanks to the explosion of e-commerce, international transactions offer enormous growth potential for Merchants.

We have entered a new world of cross-border commerce, where consumers expect easy and simple payment solutions as a matter of course.

According to a study published by EY, the total flow of cross-border payments globally is growing at around 5% (CAGR) per year and is forecast to reach $156 trillion by 2022.

Alternative payment methods, such as Wallets and Carrier billing, are particularly relevant to facilitate international payments and to bring digital services to unbanked markets in Asia, Latin America, the Middle East and Africa.

In addition to making cross-border payments, these alternative payment methods are becoming a key driver for merchants to expand into new markets in an agile and secure way.

For this to be possible, most merchants need to have payment partners and aggregators who have a local presence in the different countries, as in many cases a local presence is required in order to be able to carry out invoicing activities.

As an example, during 2021, Digital Virgo has helped the French streaming company Molotov, to deploy its business in Africa. Thanks to our local presence, our knowledge of regulation and usage on the continent and our partnership with the main Telcos in the area, we have enabled the deployment of the business on the continent.

Financial Engineering will be the key topic in 2022. Stay tuned to know more.

Want to know more about how to be prepared for these trends? Contact our experts!