Positive Impact

Aware of the importance of social, societal and environmental issues, we view the “Positive Impact” approach as a moral obligation towards our employees and stakeholders. The Group has been actively pursuing a Corporate Social Responsibility (CSR) policy since 2018.

Positive Impact Report

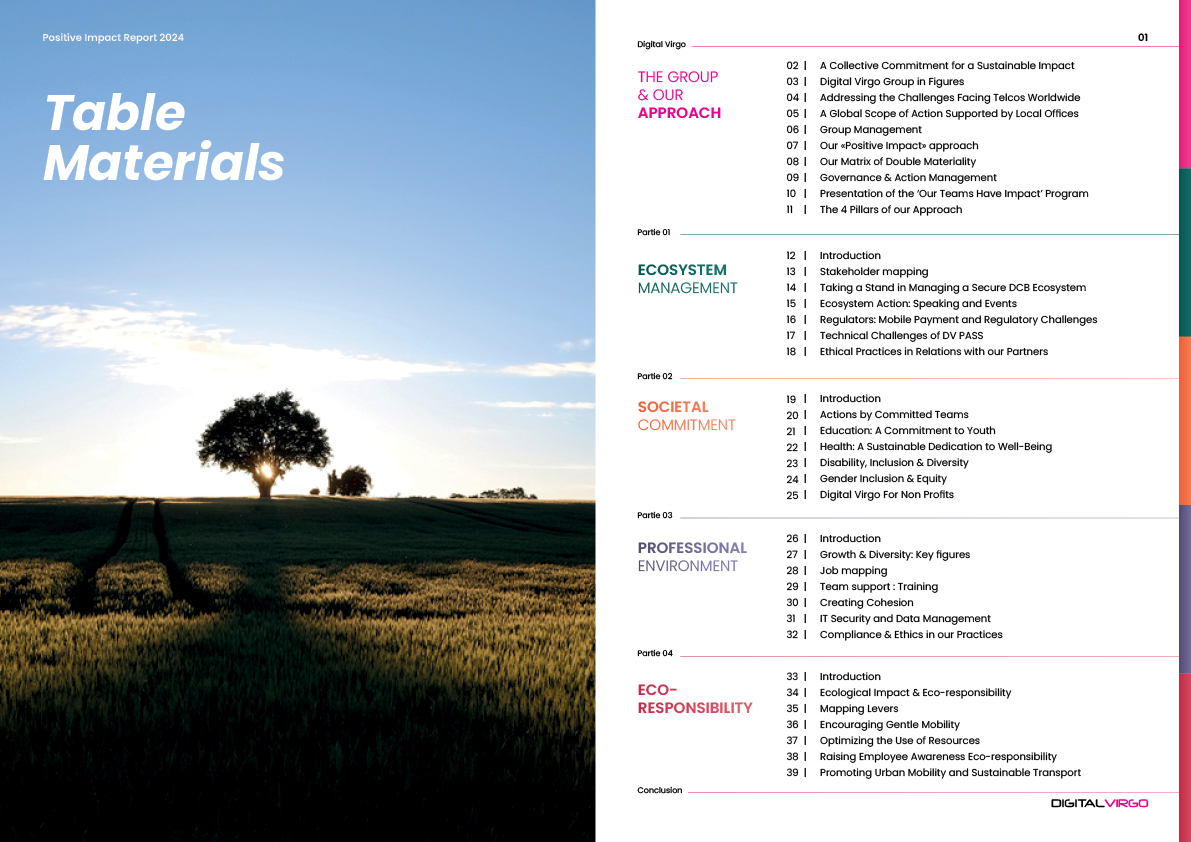

The Positive Impact priorities for the Group are as follows : Ecosystem Management – Societal Commitment – Professional Environment – Ecoresponsibility

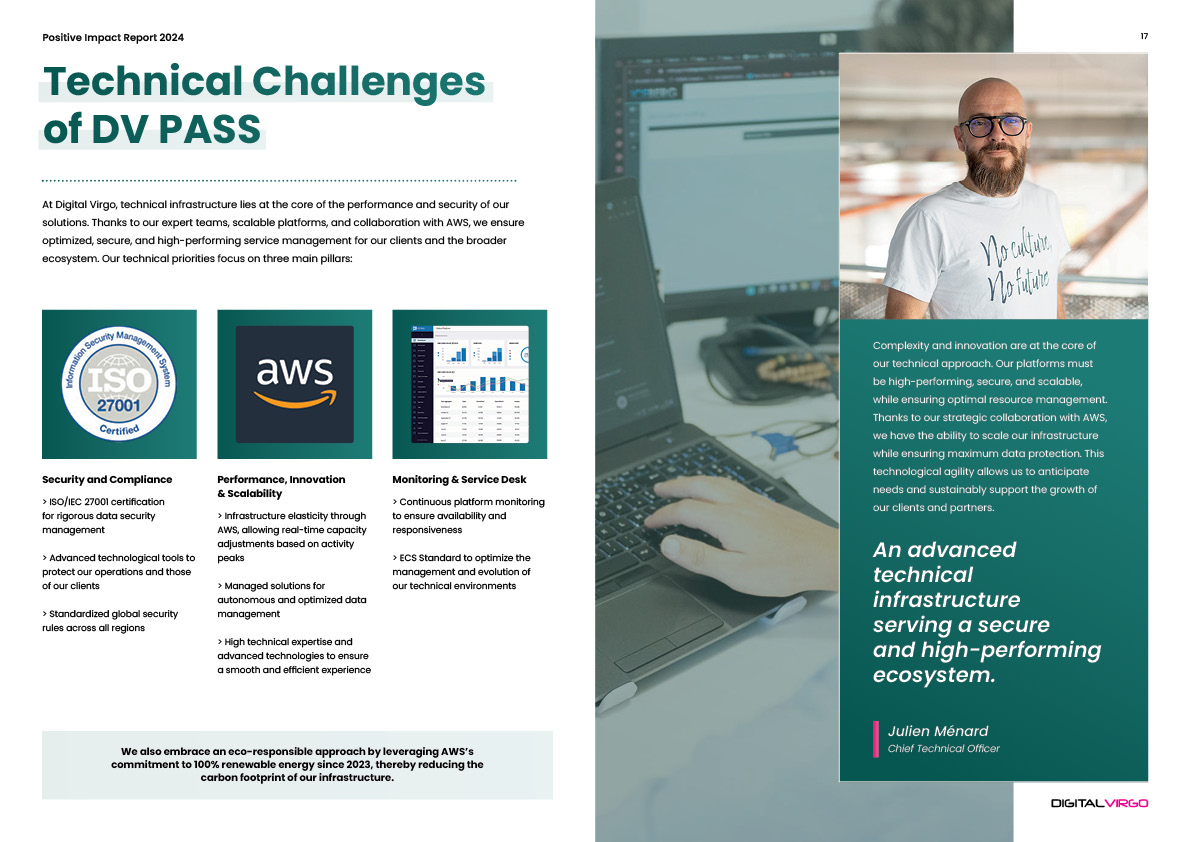

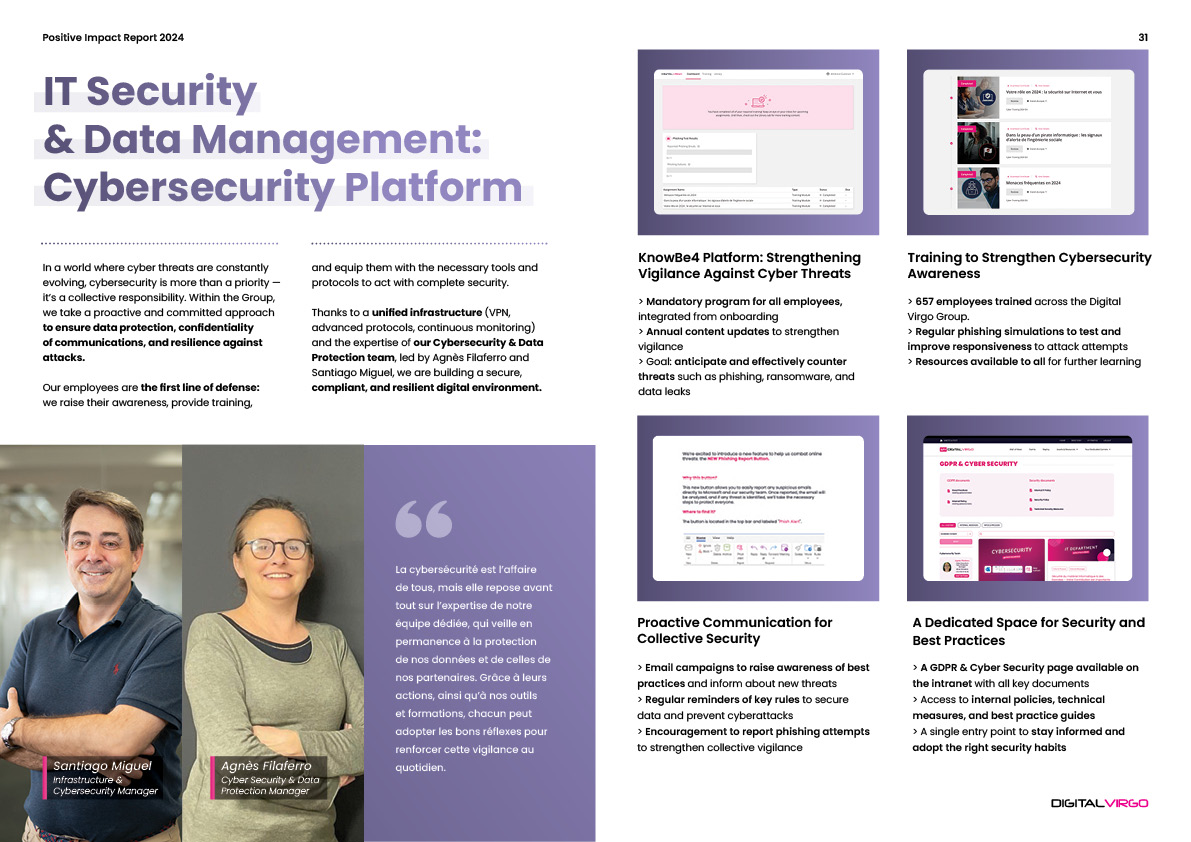

A Safe and Sustainable Ecosystem

Securing digital payments through innovation and responsibility

From fraud prevention to ethical governance, we build a secure and transparent digital environment for all our partners — fostering trust and long-term impact in the ecosystem.

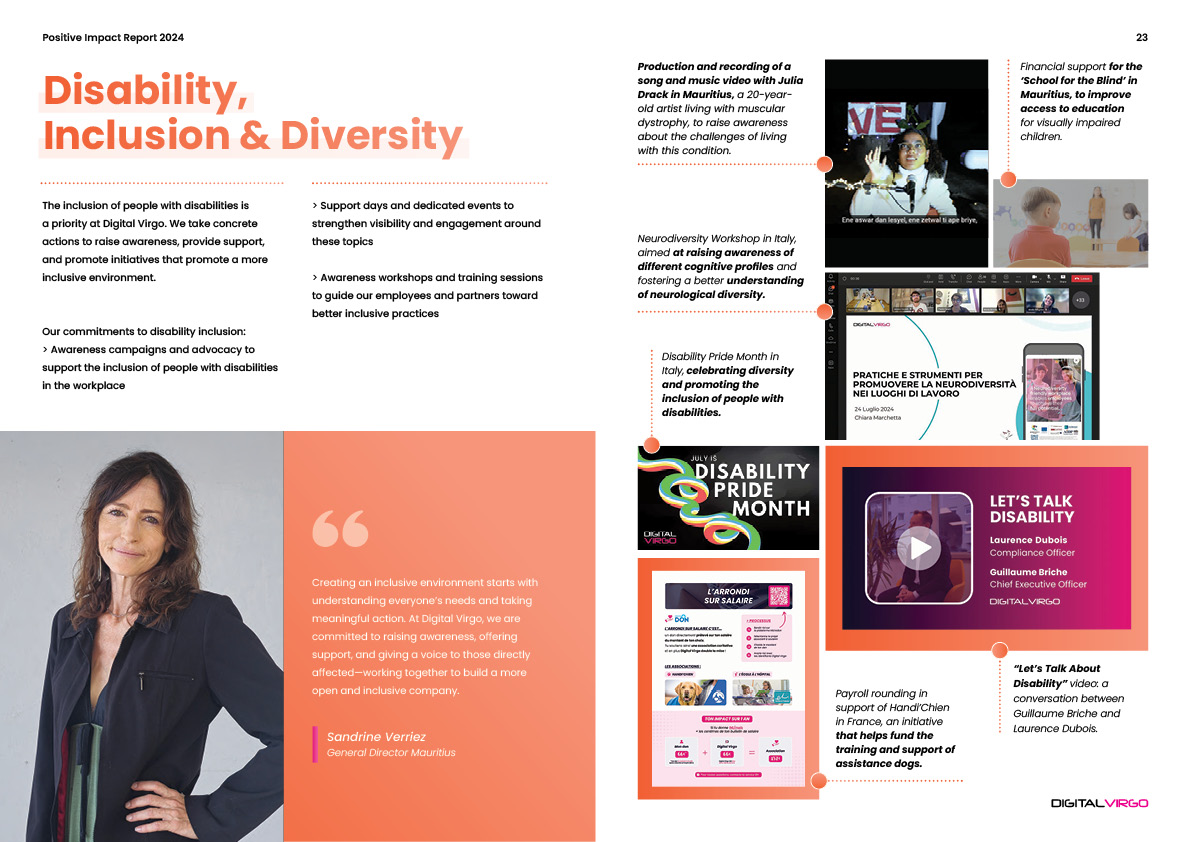

Positive Impact on Society

Acting for inclusion, education, and equality

We support local initiatives led by our teams to reduce inequalities, promote access to education, defend fundamental rights, and contribute to a more inclusive and fair society.

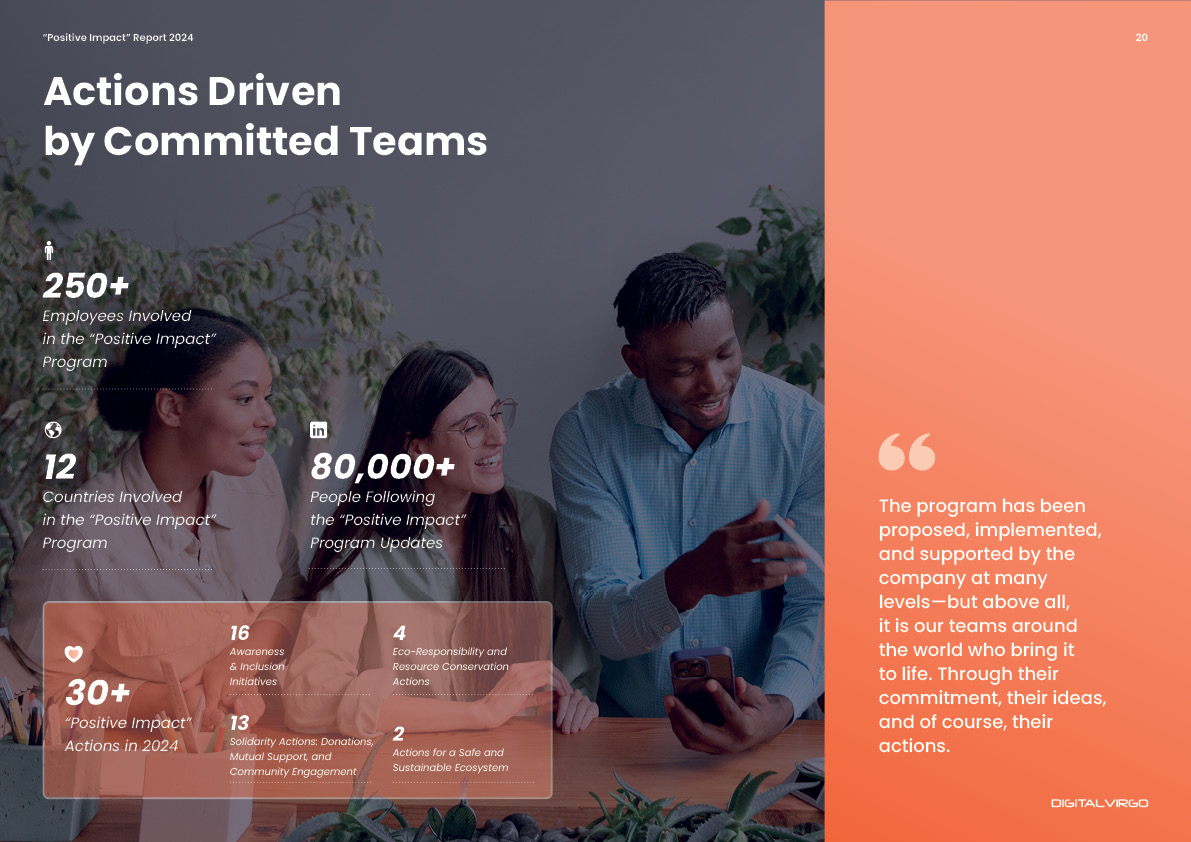

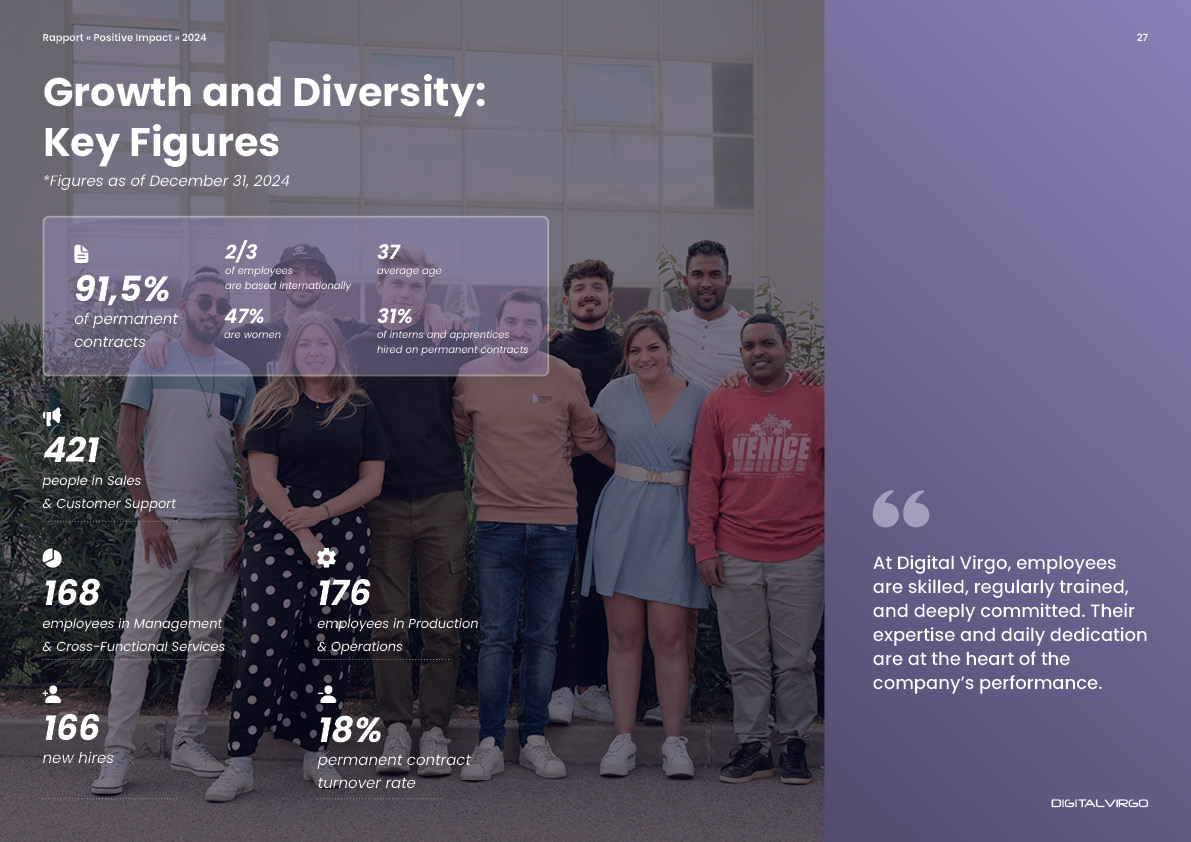

Empowered Teams, United Impact

Engaged employees at the heart of positive change

Our teams drive meaningful initiatives worldwide, supported by internal training, team cohesion programs, and a shared commitment to sustainable development.

Eco-Responsibility in Action

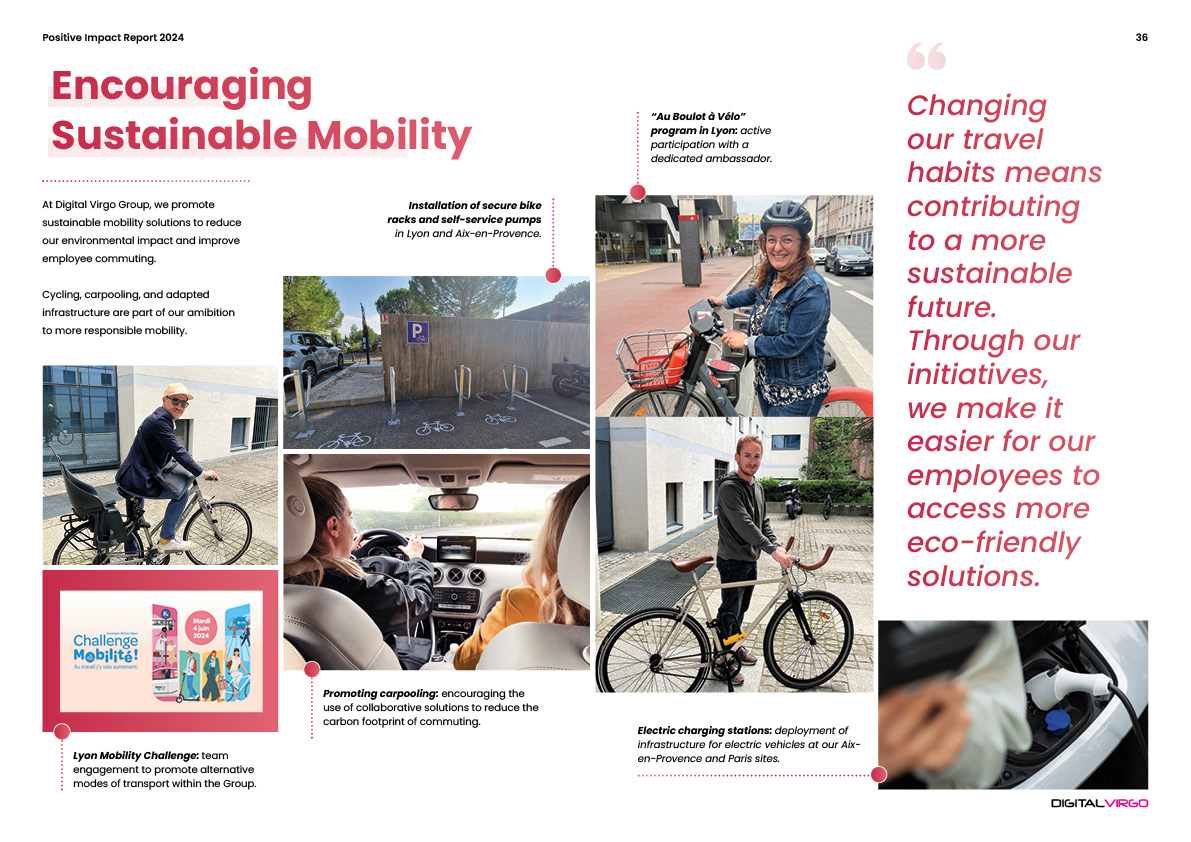

Reducing our footprint, promoting sustainable practices

We integrate eco-friendly actions at every level — from IT infrastructure and mobility to waste management — to actively support the transition to a greener future.

Discover our latest news about Positive Impact

Want to know more? Request the appendix of the Report.

Digital Virgo For NonProfits

Discover how Digital Virgo makes its services available to non-profit organisations on preferential terms. Organisations will be selected by Digital Virgo according to specific criteria.