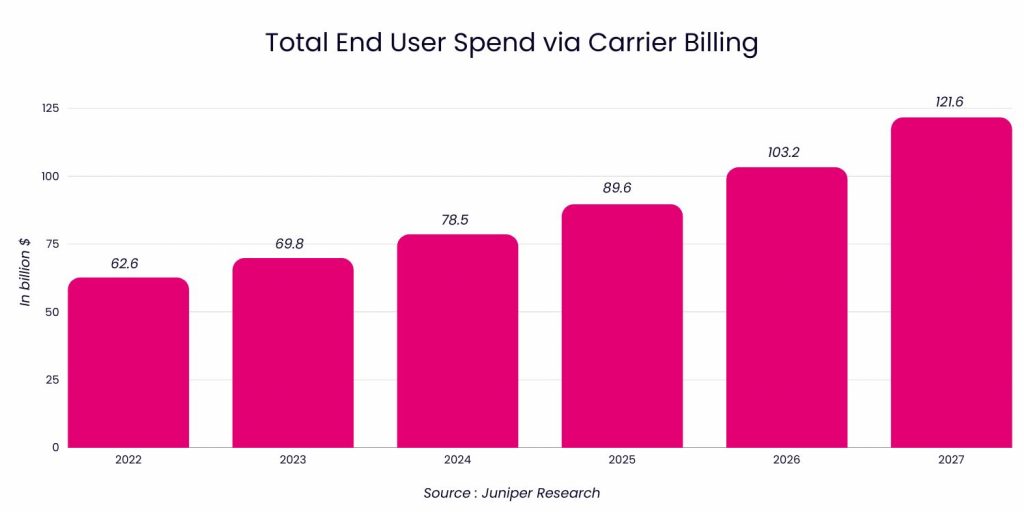

1. Carrier Billing spend will hit $122 Billion by 2027

From $70 billion in 2023 to $122 billion in 2027. The global spend of Carrier Billing will grow by 74% during this period, a CAGR of 14.9%. These figures, that show that the spend of Carrier Billing will more than double in the coming years, exemplify how DCB is having a wider reach within the population worldwide.

Far East and China, followed by North America and West Europe will lead the global DCB spend.

2. The Indian Subcontinent, MEA & Latin America, the fastest growing regions

The Indian Subcontinent and Middle East & Africa are the fastest growing regions in the Carrier Billing market. The former will see a CAGR of Carrier Billing spend of 37.7%, whereas the latter will have a CAGR of 37.3%. Both have in common an ever-growing interest in mobile payments, that has skyrocketed in recent years and that is expected to continue increasing in the following, as the mobile connections and the smartphone penetration rate grow.

In number of users, Middle East & Africa is also the leading region, going from 723 million in 2023 to 803 million in 2027. Due to the low rate of card penetration, alternative payment methods have become very popular within its population, together with the expansion of smartphone ownership.

In Latin America, a region with a traditionally low rate of financial services penetration, Carrier Billing’s spend is expected to increase from 2.6 billion in 2023 to 6.5 billion in 2027, CAGR of 25.1%. The market has shown a huge growth potential and alternative payment methods are becoming more popular, as the digital content consumption and interest have increased with better mobile connections and a higher rate of internet penetration.

3. Physical goods and ticketing, the growth driver

According to Juniper Research’s report, ticketing will be the fastest growing segment from 2023 to 2027, expanding over 200% in this period. With Mobility as a key driver of this growth, ticketing will be one of the drivers of the evolution of the market.

Currently, the largest market worldwide for ticketing is North America, with tickets for events and travel tickets as a key opportunity for Carrier Billing, together with the digitisation of all tickets.

In the same line, physical goods will also be a segment to watch out in the coming years in the Carrier Billing market, as they will account for 21% of the global spend by 2027 ($25.4 billion). In the physical goods vertical, in regions such as Europe, being compliant with the PSD2 regulation is a must in order to be able to manage these transactions. As an international player in Mobile Payment, Digital Virgo Group holds the Electronic Money Institution license, which authorizes the Group to offer payment and electronic money services throughout Europe. These authorizations are essential to support Telecom Operators and Merchants in their core business activities. The Electronic Money Institution status allows Digital Virgo’s partners to benefit from Carrier’s Billing Payment when selling physical goods.

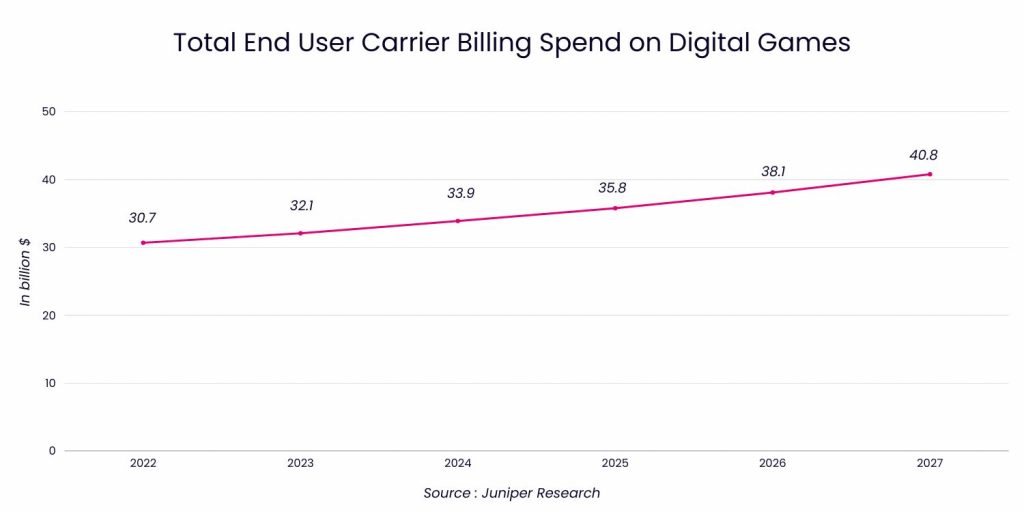

4. Digital Games will continue leading the Carrier Billing spend

It comes as no surprise that Digital Games are, and will continue to be, the most important segment in the Carrier Billing market, with an estimation to reach $40.8 billion of spend in 2027. Due to the enormous popularity of mobile gaming worldwide and the fact that carrier billing is particularly well suited to facilitate payments in this vertical, Digital Games will continue to push the rise of DCB.

5. Digital Virgo leads the Carrier Billing Vendors ranking

Among the 15 companies considered as leaders in Juniper Research’s latest report, Digital Virgo takes the number one spot of the ranking. To assess the different companies, Juniper looked at the Capability & Capacity, Product & Position and Market Presence of each of them, granting them a numeric value to create a leader board.

The core of Digital Virgo’s activities lies in its ability to connect merchants of goods and services to the billing system of telecom operators, giving consumers the possibility to pay for their products and services directly from the monthly mobile subscription bill, credits on the prepaid card, mobile money or local debit.

This model enables Digital Virgo to address the growing need for the digitalisation of payment by using simple and secure transactional channels available anywhere in the world. Digital Virgo’s added value lies in its ability to optimise payments by considering strategic aspects such as the customer journey, localisation both in terms of different cultures and technologies, digital marketing, and regulatory and compliance frameworks.

Sources

All figures in the article are extracted from Juniper Research’s Carrier Billing: Regional Analysis, Key Verticals & Market Forescasts 2023-2027 report.