Carrier billing is growing globally, with more and more consumers purchasing digital goods and services all over the world. According to a new study from Juniper Research, consumer spend via DCB mechanism is expected to rise from $28 billion in 2018 to nearly $90 billion by 2024.

For this reason, as it is for all digital payment methods, fraud management in DCB is a current rising issue that concerns all players in the ecosystem.

Digital Virgo with its Telecom Payment expertise, DV Pass, is protecting Telecom Operators and Merchants from serious consequences by developing advanced anti-fraud technologies, as well as by collaborating with the recognized expert in Mobile Fraud, Evina. Thanks to this partnership, we are able to manage a sustainable DCB Ecosystem, avoiding fraud attacks via DCB Shield, a set of three complementary protection levels to detect and prevent fraud.

In the first level, Evina expertise as a cybersecurity focused Carrier Billing expert with a global reach, provides us with a cutting-edge know-how in the detection of online fraud, which is a problem in constant evolution with new cyber security attack techniques emerging every day.

Evina offers the most advanced anti-fraud solution thanks to the combination of some key technologies. It has its own global mobile networks to attract fraudsters and reverse-engineer their patterns. The solution also integrates a Cyber Threat Intelligence task force involving in-depth analysis of threats from all sources, including the hidden ones in the dark web. These features are combined with data from millions of transactions analyzed every day, making the solution even more complete.

DCB Shield integrates also a second and third levels made of all Digital Virgo’s expertise in the ecosystem. The second level allows us to detect fraud in the subscription’s confirmation page. The third one is based on the Group’s know-how on Monetization and Acquisition business KPIS to ensure a completely secure ecosystem.

A strong Shield to fight against fraud with the most powerful weapons: Evina’s know-how in Mobile Fraud and Digital Virgo’s expertise in the management of a sustainable DCB ecosystem.

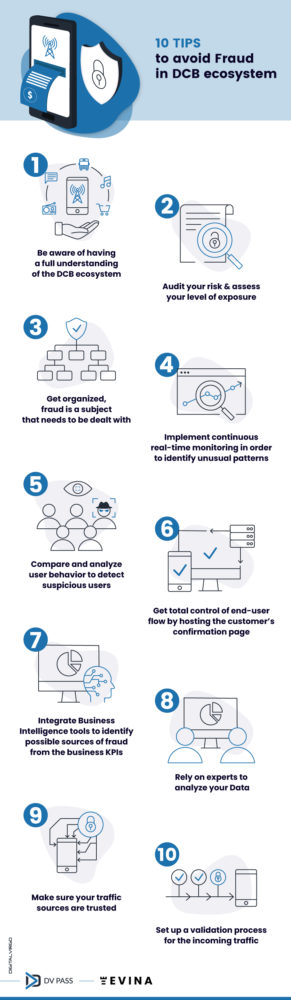

The 10 Tips Explained

Be aware of having a full understanding of the DCB business ecosystem to set the right KPIs and to establish what is the correct reference of these standardized KPIs.

Audit your risk and assess your level of exposure. Evaluate where you are the most vulnerable in terms of geography, traffic sources, service type, billing flows… And what will be the consequences of each breach. Even if there is trust between players, fraud is always a concern for all as it may happen to many different layers.

Get organized, fraud is a subject that needs to be dealt with through a step by step fraud management process including regular reporting, risk assessment, and implementation of the relevant solutions.

Implement continuous real-time monitoring in order to identify unusual patterns. By having a unique real time and interactive dashboard, most of the attacks can be prevented without affecting the user experience.

Compare and analyze user behavior. During each transaction it is essential to compare the information about the end-user. For example, if a MSISDN is doing several requests every few milliseconds, it means that not human behavior is behind this action and the transaction will be rejected.

Artificial Intelligence technology is used to detect these slight differences between suspicious or real users. It is based on the learned knowledge and the experience we have thanks to the analysis of the end-user’ behavior.

Get total control of end-user flow. An effective way to control DCB fraud is by hosting the customer’s confirmation page and analyzing all the traffic received. Digital Virgo provides its clients with this advantage by hosting the customer’s payment page.

Integrate Business Intelligence Tools to detect possible sources of fraud from the business KPIS, which could not be detected in the two previous levels.

Rely on experts to analyze your data. Collaborate with high-qualified Teams to respond to specific alarms that automations cannot detect. I.e. very successful business KPIs based on special free promotions.

Make sure your traffic sources are trusted. Ad Networks also act as a barrier to fraud. They make a first anti-fraud filter in relation to the type of the acquired consumer and directed to the payment page.

Set up a validation process for the incoming traffic. Check each new source of traffic before its validation and pay traffic only after you are sure it is legitimate. It can be done in real time with Evina or after analyzing the relevant KPIs.

Download the infographics with the 10 key tips to avoid fraud in DCB ecosystem.