Paraguay’s regional specificities and perspectives

In line with the strong digitization process of Latin America, Paraguay is experiencing a significant growth in mobile connectivity and network infrastructure. With a population of over 6.8 million (1) and more than 7.5 million SIM cards in the country (2), the digital ecosystem, that includes mobile payments and the consumption of digital content, seems as solid as ever.

Especially taking into consideration that in the country only 3% of the adult population owns a credit card, while 72% of adults have access to the internet and 89% own a mobile phone. On top of this, Mobile Money is becoming a significant force when addressing payments, as 38% of the adult population owns a Mobile Money account (3).

These figures indicate the country’s development into a more digital society, increasingly favouring online transactions over traditional payment methods, resulting in a wider reach of financial inclusion through mobile phones.

Digital Payments and E-commerce

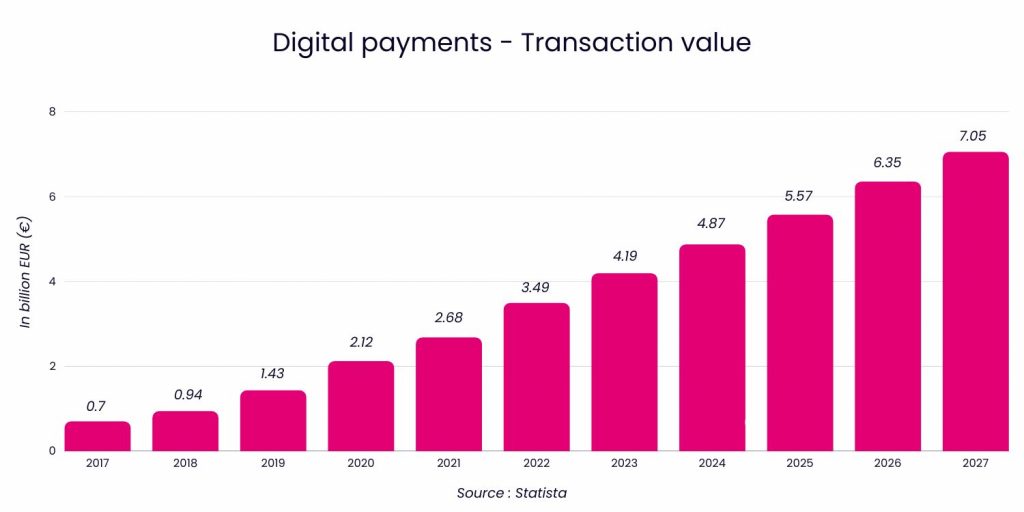

According to World Bank, 41% of adults did a digital payment in 2021 (latest data available), which evidences the widespread of digital payment methods. As a result, the total transaction value in the digital payments segment is projected to reach 4.19€ billion in 2023 and the total transaction value is expected to show an annual growth rate (CAGR 2023-2027) of 13.86% resulting in a projected total amount of 7.05€ billion by 2027 (4).

The E-commerce has also shown signs of significant growth with a transaction value projected to reach 1.4€ million in 2023 and an annual growth rate (CAGR 2023-2027) of 13.64% resulting in a projected total amount of 2.3€ million by 2027. But not only in terms of market share, the number of users is also expected to amount to 3.47 million users by 2027, which means that in the coming years, almost half of the population of the country will be buying online (48.2%). Also, the average transaction value per user in the digital commerce segment is expected to amount to over 464€ in 2023 (5).

Digital Content consumption

As a global trend, the consumption of digital goods and services has skyrocketed in recent years. Boosted by the pandemic lockdown, but solidified after it, the usage of mobile games, video streaming services and other digital services are here to stay. With a considerably young population (42.9% between 18 and 44 years old) (6), Paraguay is positioned in a favourable spot to see the digital consumption grow in the coming years.

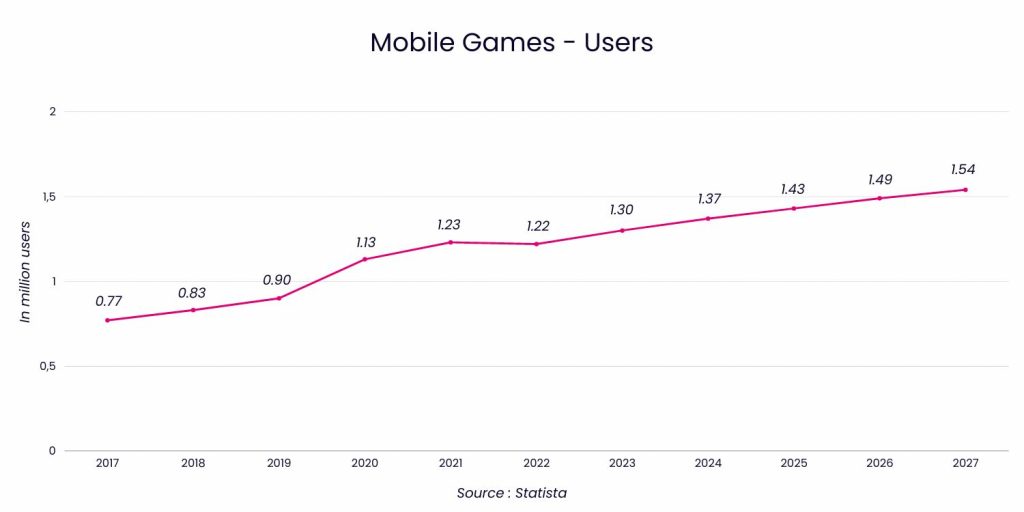

Regarding the mobile gaming market, in Paraguay it is expected to reach a total revenue 33.59€ million in 2023 (44.01€ million by 2027), according to Statista. These projections can only be achieved considering an increasing number of users, that in 2027 will hit more than 1.5 million, which means a user penetration of 20% by that year. Also, the user spend (ARPU) will experience a considerable growth, reaching 25.75€ in 2023 (7).

In the VoD segment the market is projected to reach 40.42€ million in 2023, with a user penetration of 15.6% this year and a projection to reach 18.6% in 2027. On top of that, the estimated ARPU for 2023 is set to hit 35.06€ (8).

Other digital services, such as music streaming platforms, are also growing steadily and although the user penetration is still lower (3.9% user penetration in music streaming services) (9) it still represents a great opportunity for telcos and merchants to enter the market as key players .

Sources

(1) Worldometer

(2) GSMA Intelligence

(3) World Bank: The Global Findex Database 2021

(4) Statista

(5) Statista

(6) Data Reportal

(7) Statista

(8) Statista

(9) Statista