DCB and eWallets, complementary payment options

There is no correct answer to the question of which payment option is best, DCB or eWallets. The best payment method is the one that fits the needs of a population better. Mobile Money services are growing enormously, for example, in Sub-Saharan countries. In this region alone, $697.7bn were transacted with Mobile Money in 2021, a Year-on-Year increase of 40% according to GSMA. Meanwhile, on a global scale, Carrier Billing has also become more popular than ever. Juniper Research forecasts that the market size of DCB will grow 11,75% CAGR between 2022 and 2026, from $59.7 billion to $94.2 billion.

In countries like Brazil, where Mobile Gaming has exploded in the last decade, Merchants that want to be present in this very competitive market could benefit from DCB. Carrier Billing can make a difference by offering a seamless payment method that is easy to implement and ready to go from day one. Meanwhile, in Africa, services like YouScribe, a digital library that has just hit 1 million readers in the continent, could benefit from Mobile Money due to the popularity of eWallets in the region.

All in all, the best payment method is not a single payment method, it’s a combination of all of them to enable users to choose and pay the way they prefer.

Localization of Payment Methods with DCB and eWallets

Considering a single payment method to address every market in the world is not only not effective, but also counterproductive to expand a business. Each country has its local specificities and within every country, there are different population groups that are demanding, more than ever, to be able to choose how to pay for goods and services. Moreover, each service has an ideal payment method, that can differ from one to another.

Localization of payment methods is key to engage an audience and increase revenue. Offering people different payment methods can be the ultimate catalyst to attract and build loyalty with end-users.

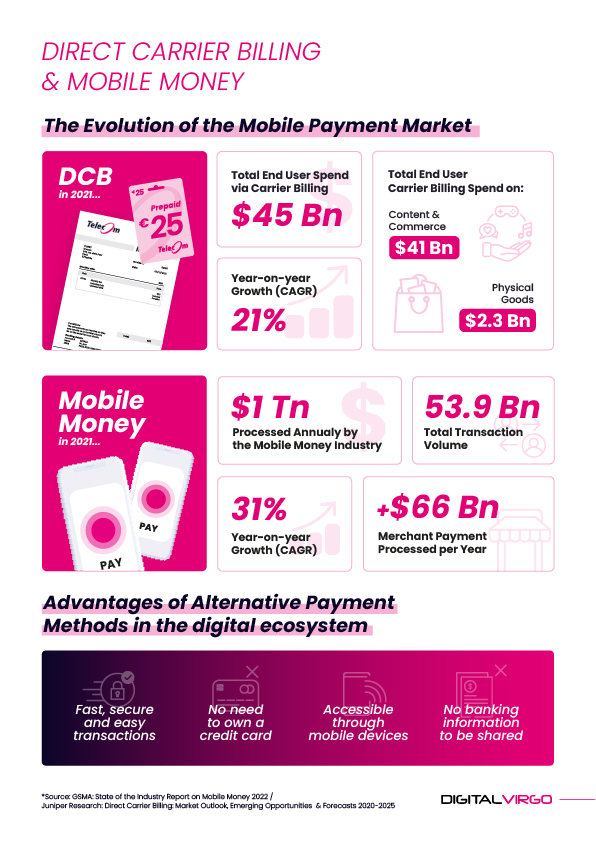

Merchants must take into consideration that opening up to payment options such as Carrier Billing or Mobile Money, which have a higher conversion rate than credit cards, is key to entering markets with huge potential. The figures are clear on this growth, in 2021 merchant payments with Mobile Money reached a grand total of $66 billion, while the end user spend via Carrier Billing was $54.4 billion.

DV PASS, the payment hub to connect to Carriers and Mobile Money providers

Recently, Digital Virgo has launched new features for DV PASS, its payment hub, that now allows a connection to some of the main Mobile Money providers in Africa. This is on top of the already existing DCB payment option. This way, Merchants will be able to offer all local payment methods (Mobile Money services, eWallets, Local Debit cards and DCB).

The platform can now manage Mobile Money services, Telco Wallets and Local Debit payments in 9 countries in Africa connecting to key Mobile Money providers and offers DCB payment method to connect to +150 Carriers worldwide.

An efficient and secure platform, easy to connect and adapted to all mobile environments. A robust technology with a seamless integration via a single API that accepts mobile payments on a global scale.

Digital Virgo offers much more than just a connection to Mobile Money providers and Carriers. Digital Marketing, legal consulting, technical support… in short, being a partner, not a client. Contact the team and get to know more on how your business can expand and internationalize with no previous investment. The best moment to go on a global scale with local adaptation is now.