New functionalities for DV PASS: the opportunity for Merchants to expand their business through eWallet payments

Mobile Money services and electronic wallets have grown in popularity over the last couple of years, especially in regions such as Africa. As an alternative payment method, Mobile Money services and eWallets are a huge development regarding Merchant payments.

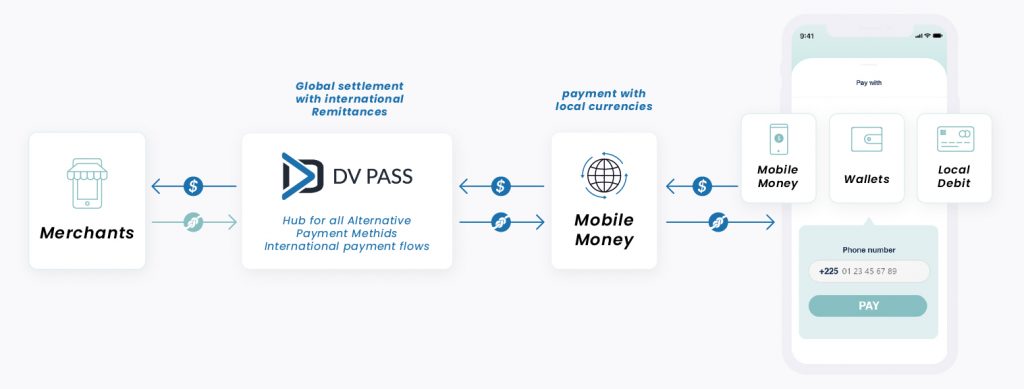

In this context, Digital Virgo has updated its payment hub, DV PASS, a simple, flexible and secure service that now allows a connection to some of the main Mobile Money providers in Africa, on top of the already existing DCB payment option. This way, Merchants will be able to offer all local payment methods (Mobile Money services, eWallets, Local Debit cards and DCB).

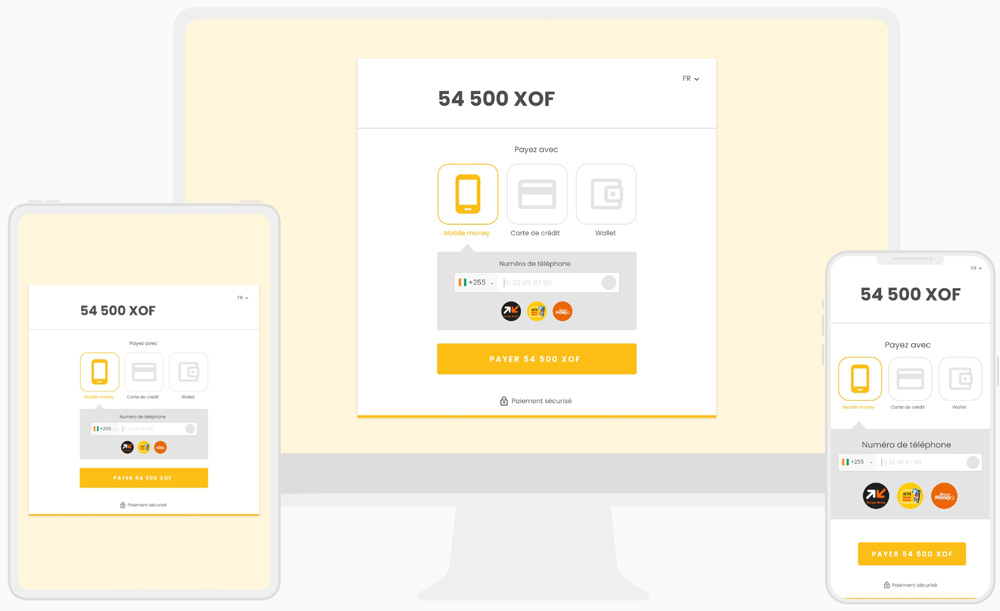

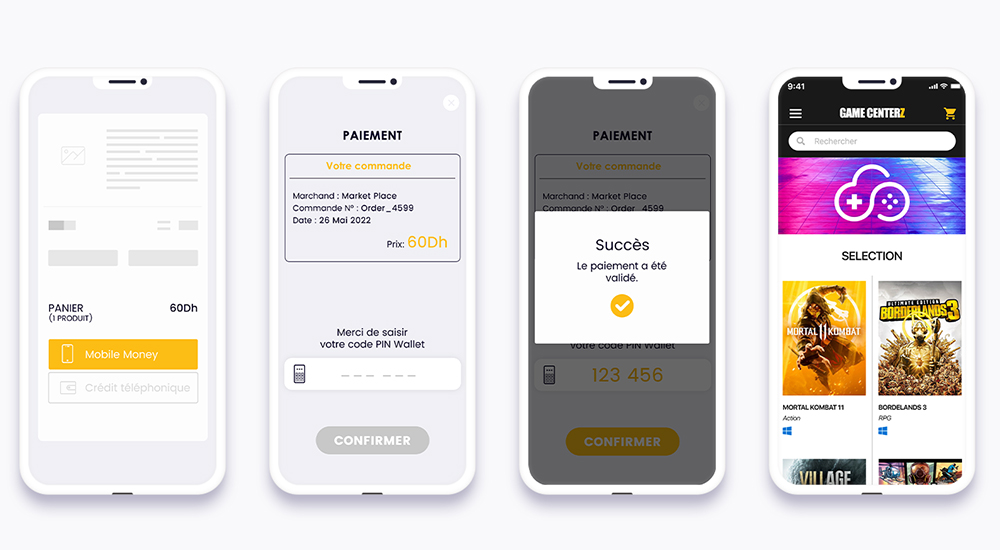

For the end-user, there is just one gateway of payment with all the available payment methods, adapted locally, with an automatic operator detection. For the Merchant, a simple bilingual interface (English / French) with multi currencies management, international flows management and the personalization of payment receipts.

The platform can now manage Mobile Money services, Telco Wallets and Local Debit payments in 9 countries in Africa (Senegal, Mali, Burkina Faso, Cameroon, Guinea, Ivory Coast, Togo, Benin and Democratic Republic of the Congo) connecting to MTN Mobile Money, M-Pesa, Orange Money or Airtel Money, among others Mobile Money providers.

How are Digital Wallet payments operated through the DV PASS platform?

We provide all players with an efficient and secured platform, easy to connect and adapted to all mobile environments. A robust technology with a seamless integration via a single API that accepts mobile payments on a global scale.

This solution is based on four main pillars:

- Simplicity: A single integration for quick and easy implementation.

- Flexibility: A platform adapted to the specificities of Merchants.

- Security: Secure transactions at the heart of all practices.

- Real-time monitoring: A real-time payment management Backoffice.

The plug & play integration is quick and easy, enabling Merchants to connect to the market-leading platforms, such as Android, iOS, Moodle or Woo Commerce, among others. The updated version of DV PASS is adapted to the specificities of Merchants and has dedicated modules to optimize the customer journey.

The DV PASS platform relies on a secure technical environment that leans on:

- PCI DSS certification: Secure/encrypted exchanges for maximum discretion of the data exchanged.

- VISA MasterCard3D SECURE: Security standard for VISA MasterCard payments.

- SSL e-Certificate: Website authentication and SSL encrypted connection for secure communication.

Get onboard! Contact our Telco Wallet, Mobile Money services and Local Debit Payment experts

Easy, simple, secure, fast, flexible… we offer a platform that makes Mobile Money payments accessible. A chance for Merchants to dive into new markets, build the loyalty of its customers and adapt to a reality that is taking over quickly.

If you want to know more about the platform, contact our experts’ teams in Marketing, Sales, IT, Finance or Legal to learn how DV PASS can help you expand your business in Africa.