Regional Specificities & Perspectives

South Africa, a land of captivating diversity, historical significance, and boundless promise, is a nation currently undergoing a profound digital transformation.

With a total population of 60.14 million in January 2023, South Africa represents a vibrant blend of cultures, ethnicities, and communities, each making its unique contribution to the nation’s diverse heritage. Notably, 68.6% of the population resides in urban areas, reflecting a strong trend toward urbanization. The median age of 27.6 years underlines the youthfulness of the population, characterized by their readiness to embrace change and innovation. (1)

In this context, South Africa reveals itself as a country where 43.48 million individuals have adopted internet, reflecting an impressive internet penetration rate of 72.3 percent. This digital connectivity has emerged as a cornerstone of South Africa’s rapidly evolving socio-economic landscape. (2)

Digital Economy & Commerce

South Africa, a country marked by vibrant urban hubs and a rapidly evolving digital landscape, stands at the forefront of the digital economy in Africa. As of early 2023, South Africa boasts one of the highest rates of internet penetration on the continent. This connectivity opens new horizons for both businesses and individuals.

However, in the digital landscape, challenges persist. According to GSMA, approximately 6 million South Africans still lack access to formal financial services, presenting an opportunity for mobile money providers to bridge this gap. Mobile technology is becoming a powerful tool in enhancing financial inclusion, yet there are hurdles to overcome. In 2021, GSMA reported a 23.53% fraud rate in South Africa, with clickjacking being a prevalent technique to defraud mobile users, highlighting the need for enhanced cybersecurity measures.

In the realm of digital payments, one notable development is the rise of Direct Carrier Billing (DCB). DCB has become a prominent payment method, offering users the convenience of charging purchases directly to their mobile phone bills. This method proves particularly advantageous in regions where traditional banking infrastructure may be less accessible.

As Cilliers Niemann, Account Manager from Digital Virgo, emphasizes “Over the past twelve months, the DCB ecosystem has undergone significant transformative developments, all contributing positively to its structure and functionality. Presently, the ecosystem boasts enhanced capabilities to propel businesses forward by leveraging appropriate strategies and cultivating partnerships. This evolution presents promising prospects that yield advantages for networks, merchants, and customers alike, fostering a landscape rich in exceptional products and compelling content spanning across different verticals.”

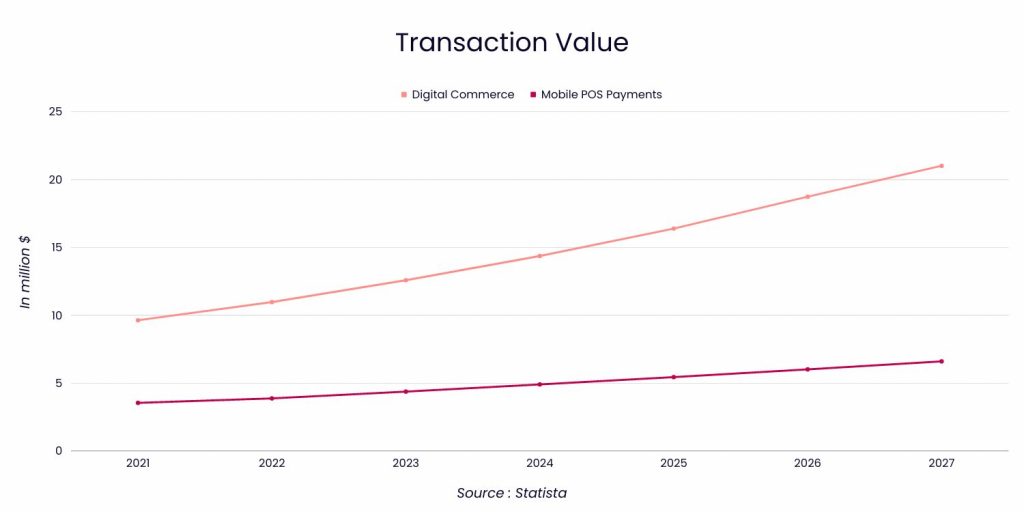

Despite these challenges, the digital payments market in South Africa is experiencing remarkable growth, with a projected total transaction value of US$17.22 billion in 2023. Looking forward, this sector is expected to maintain a robust annual growth rate of 12.88 percent from 2023 to 2027, culminating in a projected total value of US$27.96 billion by 2027. (4)

This growth is driven by various factors, such as the convenience and speed of digital payments, preferred by younger generations for their efficiency. The increasing digitization of businesses has fueled the demand for digital payment solutions, making transactions smoother and more cost-effective.

Digital Content Consumption

South Africa, with its growing digital economy and thriving e-commerce sector, is also witnessing a surge in digital media consumption, driven by a growing number of users turning to mobile devices for news and entertainment.

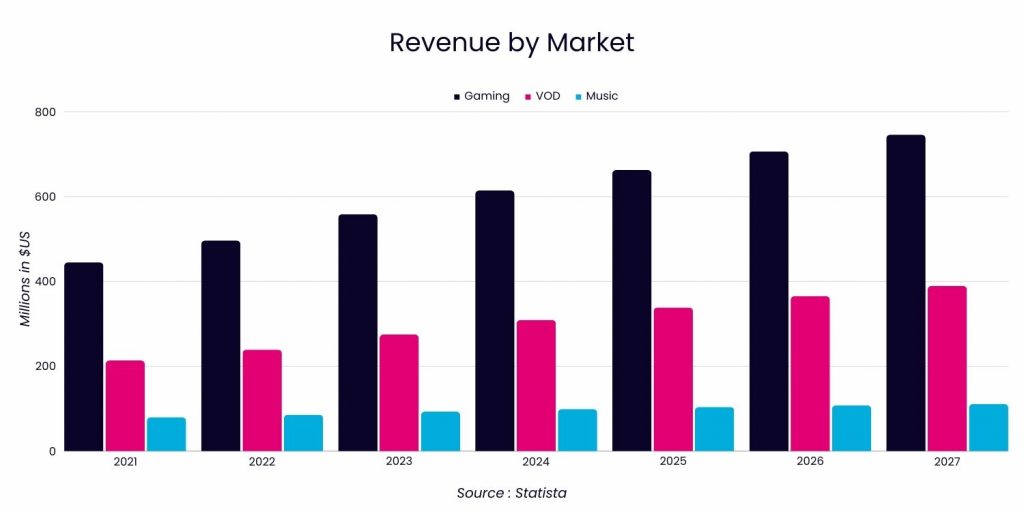

The digital media market in South Africa is poised for substantial growth, with a projected revenue of US$1,056.00 million by 2023, according to Statista. Among its segments, video games are expected to dominate, with a projected market volume of US$558.40 million in 2023, reflecting the rising popularity of gaming as a source of entertainment.

The Video-on-Demand (VoD) market is projected to have a revenue of US$275 million in 2023. Looking ahead to 2027, the penetration rate is anticipated to reach 33.21%, underlining the increasing demand for on-demand video content among South Africans.

Following closely is the music industry, with a projected revenue of US$93.2 million in 2023 and an expected penetration rate of 17.71%, indicating a growing appetite for digital music consumption. (5)

This multimedia revolution, in tandem with South Africa’s dynamic digital economy and expanding e-commerce sector, solidifies the country’s position at the forefront of the digital age. The ongoing digital transformation shapes South Africa’s cultural, entertainment, and economic landscape, creating an exciting time for the nation’s diverse and tech-savvy population.

What’s Next?

As South Africa’s digital transformation continues to unfold, it presents a wealth of opportunities and promises. From addressing financial inclusion and bolstering cybersecurity to the booming digital payments market and the surging digital media sector, the nation is primed for growth and innovation. This dynamic landscape, coupled with a tech-savvy and diverse population, holds the promise of a vibrant and prosperous digital future for South Africa. Whether in finance, technology, entertainment, or entrepreneurship, the road ahead is ripe with potential for those who seize the opportunities of this evolving digital age.

If you want to know more about the country’s possibilities, contact our team of glocal experts, and they will help you understand what is needed and how to address the market.

Sources