Digital Virgo & Evina: A strong partnership to unleash DCB growth

The cybersecurity firm Evina and the mobile payment expert Digital Virgo partnered up to reveal a few secrets on how to channel the full potential of Direct Carrier Billing (DCB).

DCB is a growing payment method and it still needs to reach the peak of its potential. As Carrier Billing is expanding worldwide, methods to defraud are also becoming more and more sophisticated. In fact, fraud is a problem that affects all players in the ecosystem: the end-user loses money, carriers lose revenue and incur extra customer service complaints and merchants lose brand reputation. A powerful and complete anti-fraud solution is therefore essential to be able to make carrier billing a foolproof payment process. DCB will become an effective tool for all market players, especially Mobile Network Operators (MNOs) to effectuate daily secure transactions in this era of digital monetization. Digital Virgo – who is evidence of the power of DCB, and Evina – cybersecurity expert, have been working together since 2018 and now operate in 30 countries, a truly great dynamic duo! Together we do much more than help each other’s business grow; we sustain the market, encourage business opportunities, detect and block fraud, improve brand image and most importantly, protect end-users. A strong partnership to turn the fight against fraud into a competitive advantage and a lever for business growth.

Read the Experts Talk between David Lotfi, CEO at Evina and Luis Vicedo, CTO at Digital Virgo. A conversation on the main keys to make carrier billing a foolproof payment process.

How to reduce fraud while increasing revenue

Luis:It is an honor to be here today to share views with our long-term partner Evina and my friend David. Looking back, with over 10 million sessions checked every month, it’s amazing what we’ve done together. I would like to start by talking about the famous balance between maintaining increased revenue for carriers and merchants and reducing or containing fraud. A much-discussed topic in the carrier billing ecosystem, which is based on fast and easy purchase flows. I will give you the floor David, not before thanking you for having this conversation with me.

David: Thank you for the introduction Luis, I’m eager to shed light on the fraud reduction/ revenue increase topic most players find confusing. Fighting against fraud doesn’t necessarily mean that one must forgo revenue growth. It’s actually quite the opposite. By eradicating fraud in the digital ecosystem, starting with the implementation of anti-fraud solutions in the products you offer, the incoming traffic is cleaner, which increases your chance of getting real clients on your platforms and consequently increases your conversion rates. You end up with real customers and greater life-time value. Cybersecurity truly needs to be thought of as a business strategy rather than a pain to treat when you’re already overwhelmed. It becomes a good business opportunity the moment you implement a thorough anti-fraud solution, just as Digital Virgo has done. A valid cybersecurity solution needs to be equipped with fast cutting-edge technology that retains real clients and reduces false positives to a minimum.

Luis: Oh, absolutely! High technology is paramount for a powerful anti-fraud solution. I would also like to mention that the first aspect to consider when talking about the carrier billing ecosystem is its business model, based on revenue sharing. This model involves some risks, such as thinking that traffic blocking and fraud fighting means less revenue growth. This is not true, since a fraud-free traffic achieves just the opposite: trusted users and increased business growth. Coming back to what you said, in fact, it is not a matter of balance. There is a direct and positive link between reducing or containing fraud and increasing revenues and/or other business KPIs such as ARPU or ROI. When we succeed in making traffic clean of fraud, the customer satisfaction and loyalty increases, user acquisition and revenue grow (even double), so everybody wins in a cycle that gives back. Understanding that combating fraud in the right way is a growth lever for business, is the key to unleash the potential of safe digital monetization.

Ensuring a sustainable ecosystem

David: … and safe digital monetization, consisting of secured flows, opens the door to many opportunities. The most effective payment flows on the market are one-click flows, yet they seem to have become a rarity as they are also responsible for attracting numerous fraudsters. For merchants, online payment aggregators and MNOs alike, one-click flows are the fastest way to win over clients and achieve higher conversion rates. To allow these market players to benefit from this type of payment flow, they must partner with a cybersecurity firm such as Evina, that guarantees the most possible fraud-free environment. Online platforms will then achieve higher conversion rates and mobile carriers will concurrently trust to work with merchants and online aggregators that demonstrate a secure payment flow.

Luis: You are totally right. For a company like Digital Virgo, it is very important to show our clients, carriers and merchants – who are investing time and money to deal with end-user complaints – what are the advantages of controlling fraud the right way. Once our partners realize that by preventing fraud the complaints are reduced and the end-user trust is back, it is easier to convince them to implement faster purchase flows such as the one-click flow – that can achieve the highest conversion rates in the market, as you mentioned before. The fact that the business grows without fraud, makes it sustainable over time. In fact, our collaboration is just about that, about maintaining a sustainable ecosystem.

To achieve this goal, it is essential to avoid any kind of fraud behavior – that can be detected in either providers, content and traffic – and to implement the same security rules for all the market. Besides, it is important to have a good balance between simple and effective acquisition flows, which result in good business KPIs for the key players of the DCB ecosystem. This is without a doubt a differential added value compared to other payment methods. Thanks to our partnership with Evina, we can manage a sustainable DCB ecosystem based on our three levels anti-fraud solution: DCB Shield. On the first level, Evina detects online fraud, which is a problem in constant evolution with new cyber security attack techniques emerging every day. DCB Shield also integrates a second and third level comprised of all Digital Virgo’s ecosystem expertise. Le deuxième niveau permet de détecter les fraudes dans la page de confirmation de l’abonnement, The third one is based on Digital Virgo’s know-how on monetization and acquisition business KPIS to ensure a completely secure ecosystem.

David: Yet a sustainable ecosystem can only be foolproof if all industry players thoroughly protect themselves against fraud. They must take an honest look at their current actions in fighting fraud and understand that only a proactive approach can be effective. Once fraudulent purchases have been prevented, an anti-fraud solution must also give the right tools to analyze the traffic and ensure that no fraudulent traffic was accepted. It only takes one of the players in the payment flow scheme who doesn’t protect itself correctly, for malwares to infiltrate and jeopardize the entire system. A united mindset is fundamental, and so is partnering with the right cybersecurity firm that checks three crucial prerequisites: full independence, 100% cyber-focused, and expertise in carrier billing. This is the reason for which we work with Digital Virgo, to fight fraud and sustain the market. Let’s look at the concrete positive impacts Evina’s partnership with Digital Virgo has had on both businesses and on the overall industry.

Evina & Digital Virgo: a successful partnership

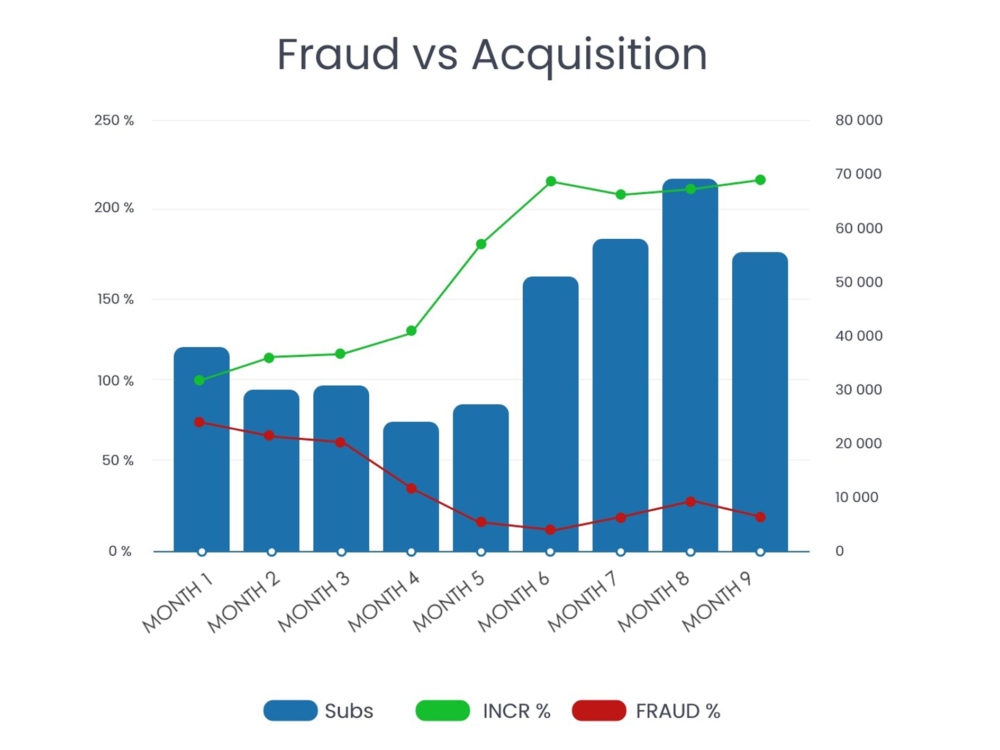

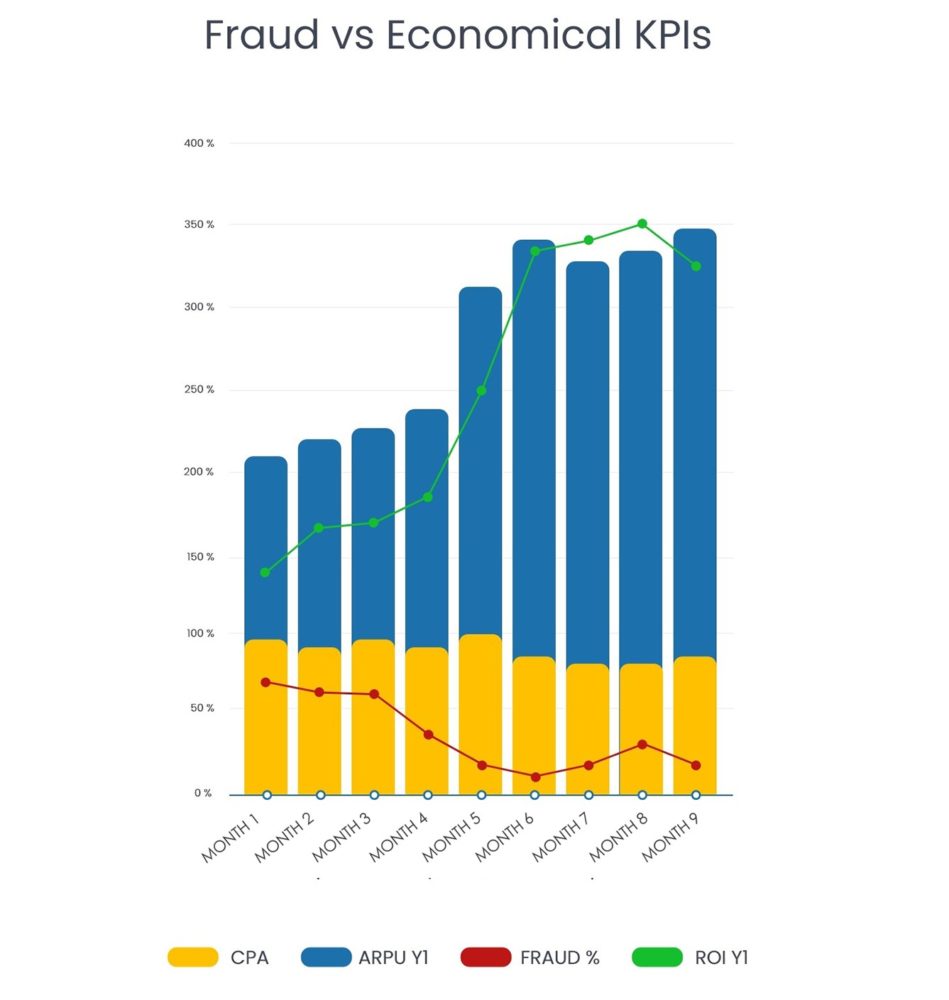

Luis: Since we joined forces and shared our know-how regarding mobile fraud – Evina – and the DCB ecosystem – Digital Virgo, we have obtained successful results in the different countries and markets where we operate together. The charts below show an example of how we successfully cleaned the ecosystem of a carrier customer.

By applying the three levels of DCB Shield solution we were able to increase the revenue by 115% in nine months, and to duplicate the Average Revenue Per User (ARPU) while reducing potential fraud rates by more than 70%.

By analyzing this data in-depth, we can prove what we have been trying to communicate all along this conversation with our partner Evina. On one hand, by guaranteeing clean flows of fraud, we see how conversion rates are growing and how carriers are regaining confidence and daring to implement one-click purchase flows (see “MONTH 5” in the charts) in some of the services provided by trusted merchants. A clear example of how, by reducing and maintaining the fraud ratio, we doubled the key business KPIs (acquisition, ARPU and ROI).

DCB: Most convenient, safe and secure payment option

It’s true, our partnership with Digital Virgo has been nothing but successful: as a payment aggregator, Digital Virgo brought its online payment expertise and its access to DCB to the table, whereas Evina contributed by bringing the most effective cybersecurity solution found on the market today. This has allowed Digital Virgo to simply focus on real subscriptions and on its business growth, while fraud rates were maintained very low. It’s clear that implementing an effective anti-fraud solution provides the possibility to clean up the market and to capitalize on real users. Today we continue to work with Digital Virgo on other operations, in numerous countries and with a variety of other partners to keep fighting fraud and ultimately, to reveal the true capabilities of DCB.

Carrier billing is full of potential, butstill has a long way to go in order to position itself as the reference mobile payment method of the future. Carrier billing is without a doubt a major revenue opportunity for MNOs and many known mobile carriers today use this payment method. Why? Because of the frictionless payment, the 10x better conversion rates, and the fact that there are five times more mobile phones than credit cards in the world today. The main obstacle that makes it difficult for carrier billing to reach its full potential are fraudsters, as this payment method only works if flows are secured and if the payments of end-users are protected. Once fraudsters are dealt with, by applying the right anti-fraud solution, fraud risks become very limited and carrier billing establishes itself as one of the most competitive payment methods on the market. Today carrier billing serves mostly digital goods, soon we expect DCB to cover physical goods, services and even loans.

Luis: I couldn’t agree more, though if I may add, in order to consolidate carrier billing as the main mobile payment it is necessary to follow and/or onboard on strong security standards like Regulatory Technical Standards on Strong Customer Authentication (RTS SCA) under Payment Security Directive (PSD2) from The European Banking Authority (EBA). This way, carrier billing will be able to fully compete with other financial players and be able to implement carrier billing in new business opportunities like the online physical goods purchase mentioned by David. Besides the regulation and security standards, it is necessary that the entire ecosystem works together to combat fraud – as it is the main barrier to market growth. A real united fight is the only way to consolidate carrier billing as the most convenient, safe and secure payment alternative.